Here illustrate the method through easy 6 Steps to calculate our 7th CPC New Pay and Allowances to know yourself

Let us assume you are drawing Grade Pay Rs.4200 and Pay in the Band Pay Rs.12110

Let us assume you are drawing Grade Pay Rs.4200 and Pay in the Band Pay Rs.12110

To calculate your Basic Pay and Allowance follow the steps given below.

Step-II

Multiply the above figure with 7th CPC Fitment Formula 2.57

16310 x 2.57 = 41916.70 . ( Paisa to be rounded off to the nearest Rupee)

The Ans is = Rs.41917

16310 x 2.57 = 41916.70 . ( Paisa to be rounded off to the nearest Rupee)

The Ans is = Rs.41917

Step-III

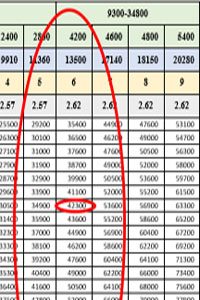

Match this Answer with Matrix Table ( Given Below) Figures assigned in Grade Pay column Rs.4200

There is no matching figure we arrived above in this matrix, so the closest higher figure assigned in the Grade Pay column can be chosen ie is Rs. 42300

So , Rs 42300 is your New 7th CPC Basic Pay

Step-IV

Identify your HRA

HRA has been revised as 24%, 16% and 8% for 30% , 20% and 10% respectively

So if you are in 30% HRA Bracket, your HRA in 7th CPC is 24% vis versa.

Let us assume now you are in 30% HRA bracket, your revised HRA is 24%

Find the 24% of the Basic Pay = 42300 x 24/100 = 10152

Your HRA is Rs.10152

Step-V

Identify your TPTA (Transport Allowance)

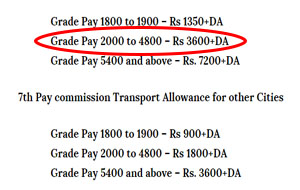

7th CPC Recommends Transport Allowance for three Category of Employees for Two Types of Places

If you are living in A1 and A classified cities you will be entitled to get higher TPTA rates

And since your Grade Pay is 4200 you fall in Second category

ie Grade Pay 2000 to 4800 – Rs 3600+DA

Your TPTA is Rs. 3600/- (DA is Nil as on 1.1.2016)

Step-VI

(Sine DA will be Zero from 1.1.2016 So no need to calculate the DA to calculate 7th Pay and Allowances from 1.1.2016)

Add all the figures

New Basic Pay + HRA+TPTA = 42300+10152+3600 = 56052

Your revised 7th CPC Grass pay as on 1.1.2016 = Rs.56052

No comments:

Post a Comment